Tax Rate For California Employees . We notify employers of their new rate each.use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking.

from www.chegg.com

California employers also need to deduct state taxes from their. Here’s what employers need to know. the highest ca sui tax rate is currently 6.2 percent which equals a maximum tax of $434 per employee, per.

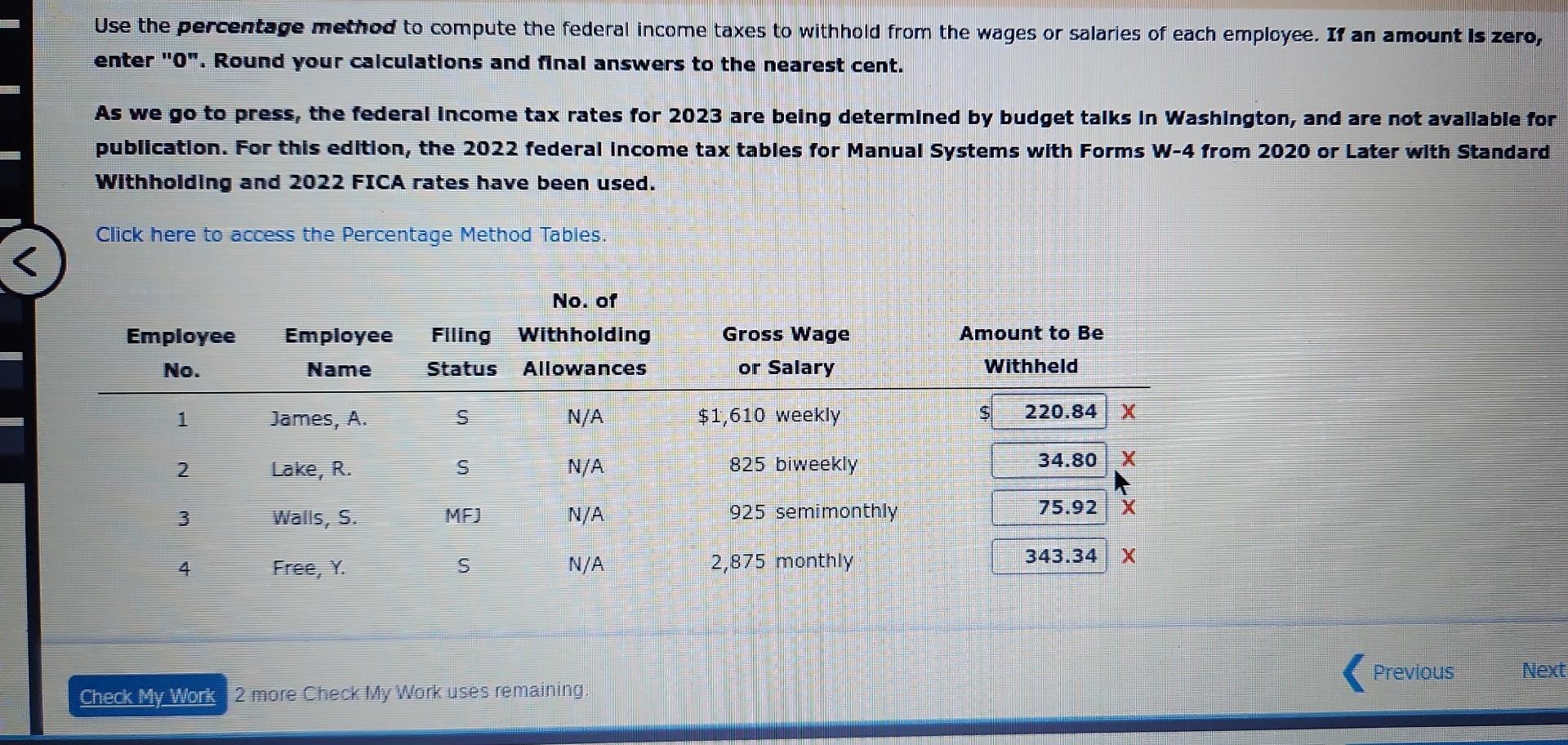

Use the percentage method to compute the federal

Tax Rate For California Employees the futa rate for 2023 is 6.0%, but many employers are able to pay less, for instance, up to 5.4% each year due to tax credits.the futa rate for 2023 is 6.0%, but many employers are able to pay less, for instance, up to 5.4% each year due to tax credits. the highest ca sui tax rate is currently 6.2 percent which equals a maximum tax of $434 per employee, per.what is the employee portion of payroll taxes in california?

From jabberwocking.com

Texas has lower taxes than California . . . for some people Kevin Drum Tax Rate For California Employeesuse smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking.what is the employee portion of payroll taxes in california? We notify employers of their new rate each.new employers pay 3.4 percent (.034) for a period of two to three years. Here’s what employers need to. Tax Rate For California Employees.

From www.hechtgroup.com

Hecht Group What Is The Commercial Property Tax Rate In California Tax Rate For California Employees the highest ca sui tax rate is currently 6.2 percent which equals a maximum tax of $434 per employee, per. California employers also need to deduct state taxes from their.what is the employee portion of payroll taxes in california? California has one of the country's most complicated tax.use smartasset's paycheck calculator to calculate your take. Tax Rate For California Employees.

From www.taxtips.ca

TaxTips.ca Business 2021 Corporate Tax Rates Tax Rate For California Employees Here’s what employers need to know.use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking. California has one of the country's most complicated tax.new employers pay 3.4 percent (.034) for a period of two to three years.the futa rate for 2023 is 6.0%, but. Tax Rate For California Employees.

From napavalleyregister.com

New California city sales tax rates take effect on April 1 Business Tax Rate For California Employees California has one of the country's most complicated tax. We notify employers of their new rate each. the highest ca sui tax rate is currently 6.2 percent which equals a maximum tax of $434 per employee, per. California employers also need to deduct state taxes from their.the futa rate for 2023 is 6.0%, but many employers are. Tax Rate For California Employees.

From www.legalreader.com

At the End of the Day, How Much Does an Employee Cost? Legal Reader Tax Rate For California Employeeswhat is the employee portion of payroll taxes in california? We notify employers of their new rate each. California employers also need to deduct state taxes from their.use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking.the futa rate for 2023 is 6.0%, but many. Tax Rate For California Employees.

From federal-withholding-tables.net

California Tax Rates 2021 Table Federal Withholding Tables 2021 Tax Rate For California Employees We notify employers of their new rate each. Here’s what employers need to know.what is the employee portion of payroll taxes in california?use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking. California employers also need to deduct state taxes from their. Tax Rate For California Employees.

From taxfoundation.org

California’s Corporate Tax Rate Could Rival the Federal Rate Tax Rate For California Employees California employers also need to deduct state taxes from their.the futa rate for 2023 is 6.0%, but many employers are able to pay less, for instance, up to 5.4% each year due to tax credits. Here’s what employers need to know.use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and. Tax Rate For California Employees.

From www.chegg.com

Use (a) the percentage method and (b) the Tax Rate For California Employees California has one of the country's most complicated tax.what is the employee portion of payroll taxes in california?new employers pay 3.4 percent (.034) for a period of two to three years. We notify employers of their new rate each.use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and. Tax Rate For California Employees.

From www.marca.com

Tax payment Which states have no tax Marca Tax Rate For California Employees We notify employers of their new rate each.what is the employee portion of payroll taxes in california? Here’s what employers need to know.new employers pay 3.4 percent (.034) for a period of two to three years.use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after. Tax Rate For California Employees.

From taxfoundation.org

State & Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation Tax Rate For California Employeesuse smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking. We notify employers of their new rate each.the futa rate for 2023 is 6.0%, but many employers are able to pay less, for instance, up to 5.4% each year due to tax credits. Here’s what employers need. Tax Rate For California Employees.

From w4-form-2018-printable.com

Ca De 4 Printable Form California Employee's Withholding Allowance Tax Rate For California Employees We notify employers of their new rate each.use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking. California employers also need to deduct state taxes from their.new employers pay 3.4 percent (.034) for a period of two to three years.the futa rate for 2023. Tax Rate For California Employees.

From taxwalls.blogspot.com

How Much Tax Do You Pay In California Tax Walls Tax Rate For California Employeesuse smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking. We notify employers of their new rate each.the futa rate for 2023 is 6.0%, but many employers are able to pay less, for instance, up to 5.4% each year due to tax credits. California employers also need. Tax Rate For California Employees.

From lajolla.com

California Corporate Tax Rate A Comprehensive Guide for Businesses Tax Rate For California Employeeswhat is the employee portion of payroll taxes in california?the futa rate for 2023 is 6.0%, but many employers are able to pay less, for instance, up to 5.4% each year due to tax credits. the highest ca sui tax rate is currently 6.2 percent which equals a maximum tax of $434 per employee, per. Here’s. Tax Rate For California Employees.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax Tax Rate For California Employeesnew employers pay 3.4 percent (.034) for a period of two to three years. We notify employers of their new rate each.use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking. California employers also need to deduct state taxes from their. the highest ca sui tax. Tax Rate For California Employees.

From www.chegg.com

Use the percentage method to compute the federal Tax Rate For California Employees We notify employers of their new rate each.use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking. Here’s what employers need to know. the highest ca sui tax rate is currently 6.2 percent which equals a maximum tax of $434 per employee, per.what is the. Tax Rate For California Employees.

From soquelbythecreek.blogspot.com

Creekside Chat Examining Governor Jerry Brown's Proposed Tax Increases Tax Rate For California Employeeswhat is the employee portion of payroll taxes in california? We notify employers of their new rate each.the futa rate for 2023 is 6.0%, but many employers are able to pay less, for instance, up to 5.4% each year due to tax credits. California has one of the country's most complicated tax. the highest ca sui. Tax Rate For California Employees.

From taxfoundation.org

State Individual Tax Rates and Brackets 2017 Tax Foundation Tax Rate For California Employees California has one of the country's most complicated tax.new employers pay 3.4 percent (.034) for a period of two to three years. California employers also need to deduct state taxes from their. Here’s what employers need to know.what is the employee portion of payroll taxes in california? Tax Rate For California Employees.

From irvin-has-thornton.blogspot.com

Which of the Following Is Not an Employer Payroll Cost IrvinhasThornton Tax Rate For California Employees We notify employers of their new rate each.new employers pay 3.4 percent (.034) for a period of two to three years. Here’s what employers need to know.what is the employee portion of payroll taxes in california?use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after. Tax Rate For California Employees.